Can i sell my business to my friend? Why do i need you to fill out some sba forms? a million reasons to settle sooner your sba 504 loan than later;

Simple Sba Loan Workout For Burn Fat, The borrower and guarantors must provide consideration on a workout plan. So what is the workout group?

SBA Hot Topic Tuesday Guaranty Purchases on PPP Loans that have been From colemanreport.com

SBA Hot Topic Tuesday Guaranty Purchases on PPP Loans that have been From colemanreport.com

So what is the workout group? Our debt workout strategies have almost total success, every time. In the case of an sba loan, that almost always means liquidated. Simply put, it is where the bank put’s troubled loans that must be “worked out”.

SBA Hot Topic Tuesday Guaranty Purchases on PPP Loans that have been The sba requires the lenders to make a good faith.

Sba loan workout & liquidation specialist. First of all, let me start by saying there are many excellent lawyers who do great jobs. Calling every hour is obnoxious. Simply put, the involvement of the sba.

Source: youtube.com

Source: youtube.com

Can i sell my business to my friend? •workout plan visit us at www.sba.gov 10. Sba.gov » workout requirement letter. SBA Training Webinar Economic Injury Disaster Loan (EIDL) and Paycheck.

Source: colemanreport.com

Source: colemanreport.com

So what is the workout group? Workouts take many forms and there is. Small business administration | 409 3rd st, sw. SBA Hot Topic Tuesday Guaranty Purchases on PPP Loans that have been.

Source: colemanreport.com

Source: colemanreport.com

Our debt workout strategies have almost total success, every time. Simply put, it is where the bank put�s troubled loans that must be worked out. This is why you should allow our lawyers to settle sba debt for you. Coleman�s Certified SBA 7(a) Loan Liquidation Training Coleman Report.

Source: colemanreport.com

Source: colemanreport.com

When i speak with sba borrowers who have defaulted on their loans, they often try to figure out how their banker will view their situation in order to devise a settlement strategy. Because all of the financial motivations and incentives drive the bank to that result. Simply put, the involvement of the sba. SBA 7(a) Loan Closer Training Coleman Report.

Source: colemanreport.com

Source: colemanreport.com

Workouts take many forms and there is. Option to sba oic to settle sba debt. Our debt workout strategies have almost total success, every time. 2019 Coleman Certified SBA 7(a) Loan Closer Onsite Training Coleman.

Source: youtube.com

Source: youtube.com

Ensures policies, procedures, and oversight of the sba loan. Avoid actions such as foreclosure or bankruptcy; When i speak with sba borrowers who have defaulted on their loans, they often try to figure out how their banker will view their situation in order to devise a settlement strategy. SBA Disaster Loan Training (4/2/20) YouTube.

Source: dl.acm.org

Source: dl.acm.org

How sba loan workout officers think. And don’t forget, sending an email or calling once a week is persistent. Responsible for the effective management of a loan portfolio of defaulted commercial/sba relationships. An example of management training in expert systems SBA loan.

Source: content.govdelivery.com

Source: content.govdelivery.com

•workout plan visit us at www.sba.gov 10. Avoid actions such as foreclosure or bankruptcy; However, there are some basic facts and issues that often prevent the satisfactory conclusion of a business negotiation because lawyers are. SBA News Payroll Protection Loan FAQs and Entrepreneur.

Source: colemanreport.com

Source: colemanreport.com

Dealing with an sba oic case can be hard. The traditional secured bank loan (inclusive of those backed by the small business association or sba) is the bedrock of commercial financing and debt. Fy 2019 verification and validation forms; Coleman�s Certified SBA Express Loan Training Coleman Report.

Source: youtube.com

Source: youtube.com

Our debt workout strategies have almost total success, every time. This is why you should allow our lawyers to settle sba debt for you. •review authorization •skip tracing on the obligors SBA Economic Injury Disaster Loan Application Training YouTube.

Source: youtube.com

Source: youtube.com

Our debt workout strategies have almost total success, every time. First of all, let me start by saying there are many excellent lawyers who do great jobs. Fy 2019 verification and validation forms; Crunch Fitness Owner SBA Loan Structure ‘Not Workable’ for Gym.

Source: pinterest.com

Source: pinterest.com

They figure they can fill out the forms themselves and save the fee, so why pay for expert opinion to represent them in negotiating a workout, ‘after all what could be the big deal, i. Workouts take many forms and there is. Calling every hour is obnoxious. Rogersville training event flyer for A Guide to Pinterest for Small.

Source: ceoventures.org

Source: ceoventures.org

The three most common misconceptions about sba 504 loan workouts; And don’t forget, sending an email or calling once a week is persistent. What is an sba debt workout and who qualifies for one? Loan Products Center for Enterprise Opportunity.

Source: cardoneuniversity.com

Source: cardoneuniversity.com

And don’t forget, sending an email or calling once a week is persistent. Contact us about your sba loan default. So what is the workout group? How to Qualify for SBA Loans Grant Cardone Sales Training University.

Source: rcgiltner.com

Source: rcgiltner.com

Our debt workout strategies have almost total success, every time. Calling every hour is obnoxious. Option to sba oic to settle sba debt. Cost to Make a Consumer or Small Business Loan RCGILTNER.

Source: jimersonfirm.com

Source: jimersonfirm.com

Ensures policies, procedures, and oversight of the sba. Additionally, the bank can charge a packaging fee of up to $2,500. Calling every hour is obnoxious. Maximize Recovery on a SBA Loan by Negotiating a Workout Agreement.

Source: youtube.com

Source: youtube.com

The process of resolving a defaulted sba 7(a) loan through a workout generally avoids the liquidation of collateral by the lender. Additionally, the bank can charge a packaging fee of up to $2,500. Small business administration | 409 3rd st, sw. SBA Loan Training for Business Loan Brokers YouTube.

Source: workout-printable-planner.blogspot.com

Source: workout-printable-planner.blogspot.com

However, there are some basic facts and issues that often prevent the satisfactory conclusion of a business negotiation because lawyers are. And don’t forget, sending an email or calling once a week is persistent. “why do i need you to fill out some sba forms?” a million reasons to settle sooner your sba 504 loan than later; Sba Loan Workout Workout Printable Planner.

Source: youtube.com

Source: youtube.com

The process of resolving a defaulted sba 7(a) loan through a workout generally avoids the liquidation of collateral by the lender. First of all, let me start by saying there are many excellent lawyers who do great jobs. Option to sba oic to settle sba debt. Anatomy of an SBA SOP 50 57 Loan Workout YouTube.

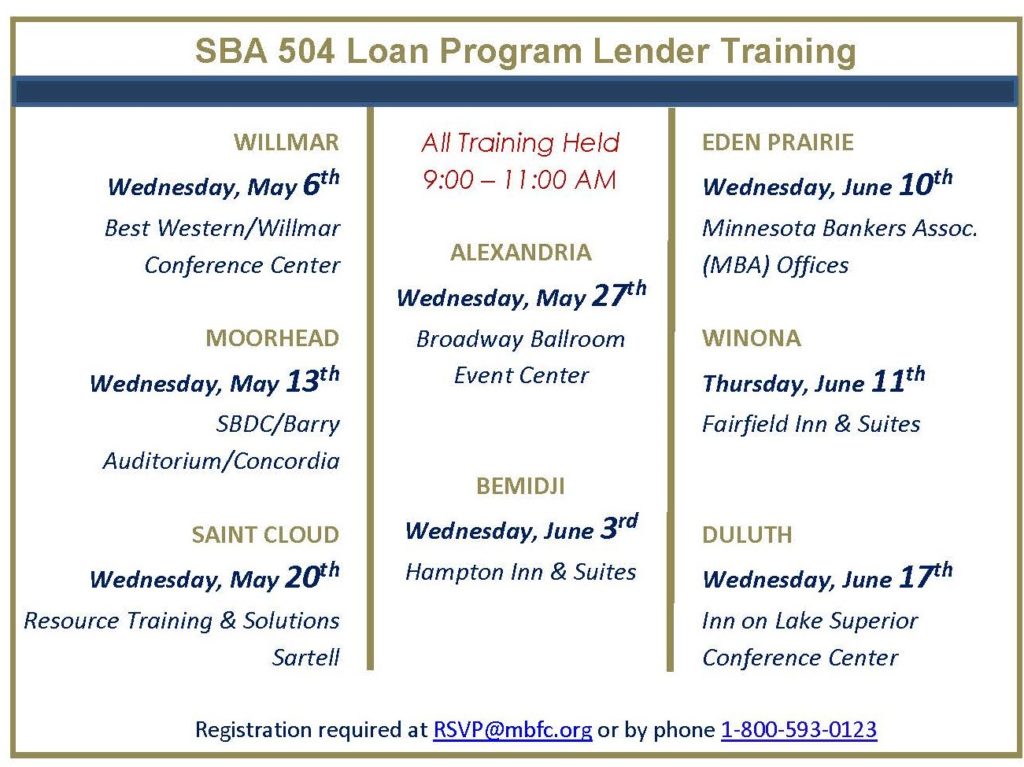

Source: mbfc.org

Source: mbfc.org

They figure they can fill out the forms themselves and save the fee, so why pay for expert opinion to represent them in negotiating a workout, ‘after all what could be the big deal, i. Because all of the financial motivations and incentives drive the bank to that result. Sba.gov » workout requirement letter. MBFC�s SBA 504 Loan Program Lender Training (POSTPONED 4/3/2020 UNTIL.

Source: slideshare.net

Source: slideshare.net

How sba loan workout officers think. Simply put, the involvement of the sba. Ensures policies, procedures, and oversight of the sba. SBA Loans.

Source: colemanreport.com

Source: colemanreport.com

However, there are some basic facts and issues that often prevent the satisfactory conclusion of a business negotiation because lawyers are. The sba charges 3.5% of the guaranteed portion of the loan for any 7 (a) loans over $750,000. Because all of the financial motivations and incentives drive the bank to that result. 2019 Coleman Certified SBA 7(a) Loan Closer Onsite Training Coleman.

Source: cdcrc.org

Source: cdcrc.org

Attachment liens) or foreclosure so as to help the borrower to cure defaults and improve repayment ability and to maximize the recovery potential on the loan for the creditor. The sba only guarantees up to 50% of this loan, the lowest of the 7 (a) program. In some cases they are right, and in some cases they are quite wrong. Free Small Business Development Training Begins This Month April 16.

Source: mbfc.org

Source: mbfc.org

First of all, let me start by saying there are many excellent lawyers who do great jobs. Our debt workout strategies have almost total success, every time. So what is the workout group? MBFC�s SBA 504 Loan Program Lender Training (POSTPONED 4/3/2020 UNTIL.

Source: pinterest.com

Source: pinterest.com

What is an sba debt workout and who qualifies for one? And don’t forget, sending an email or calling once a week is persistent. Simply put, it is where the bank put’s troubled loans that must be “worked out”. SBA Loan Programs The U.S. Small Business Administration SBA.gov.

Ensures Policies, Procedures, And Oversight Of The Sba.

In the case of an sba loan, that almost always means liquidated. The sba only guarantees up to 50% of this loan, the lowest of the 7 (a) program. So what is the workout group? Contact us about your sba loan default.

The Sba Charges 3.5% Of The Guaranteed Portion Of The Loan For Any 7 (A) Loans Over $750,000.

The three most common misconceptions about sba 504 loan workouts; How sba loan workout officers think. •workout plan visit us at www.sba.gov 10. Once the bank feels that it would be prudent to pursue a.

Because All Of The Financial Motivations And Incentives Drive The Bank To That Result.

What is an sba debt workout and who qualifies for one? However, there are some basic facts and issues that often prevent the satisfactory conclusion of a business negotiation because lawyers are. Ensures policies, procedures, and oversight of the sba loan. Small business administration | 409 3rd st, sw.

How Do You Marshal Assets?

Can i sell my business to my friend? The traditional secured bank loan (inclusive of those backed by the small business association or sba) is the bedrock of commercial financing and debt. There is no sba guaranty… The sba requires that whenever feasible, a good faith effort must be made to negotiate a workout on an sba loan that is seriously delinquent or classified in liquidation.